Need cash today?

We offer easy online loans.

Applying is quick, simple & confidential!

Same or next day payments.

Need cash today?

We offer easy online loans.

Applying is quick, simple & confidential!

Same or next day payments.

Personal loans

Flexible Loan Solutions

- Short-term personal loan solutions (up to 12 months)

- Mid-term loan solutions (up to 24 months)

- Flexible loan solutions (up to 7 years)

Competitive rate loans

Get low rates on loans of $5,000 – $80,000

Life has big moments, and sometimes you need a financial boost. Whether it’s a dream renovation, a car you can rely on, or consolidating debt, our personal loans from $5,000 to $80,000 can help you achieve your goals. We offer competitive rates and flexible repayment terms to fit your budget, and individualised assessments to get you the best loan rate possible.

Mid-size loans

$5,001 – $25,000

Large loans

$25,000 – $80,000

SAAC & MAAC Loans

Responsible Alternatives to Payday Loans

Life throws curveballs, and sometimes unexpected bills can strain your budget. Whether it’s a car repair, medical expense, or simply needing to bridge the gap until your next payday, our urgent loans could offer a helping hand when you need it most. Alternatively, our $500 Second Chance loans offer no credit check finance.

Small loans

Up to $2,000

Medium loans

Up to $5,000

Help Centre

Information & FAQs

Need help understanding how our loans work, how to get our lowest loan rates, or how to get approved?

Our best loan rates

Competitive rate loans & fees from

$5,000 – $80,000

Plus responsible alternatives to payday loans for urgent loans up to $5,000

Emergency loans

Unexpected expenses

Weddings & events

Celebrations & functions

Car loans

Personal loans for purchasing a new car

Purchases

Furniture, electronics, white goods

Travel & leisure

Exciting experiences

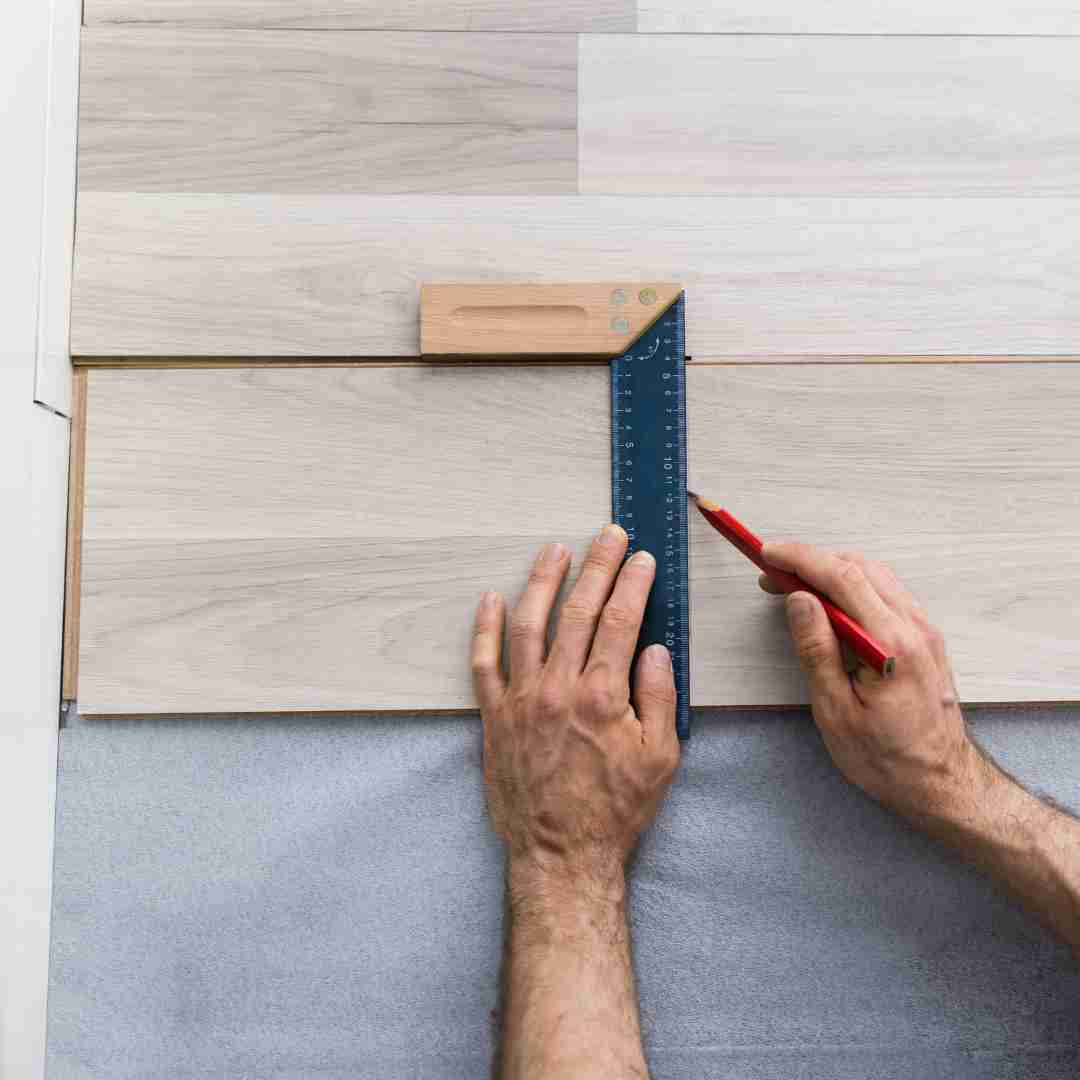

Home improvement

Renovations, upgrades, repairs

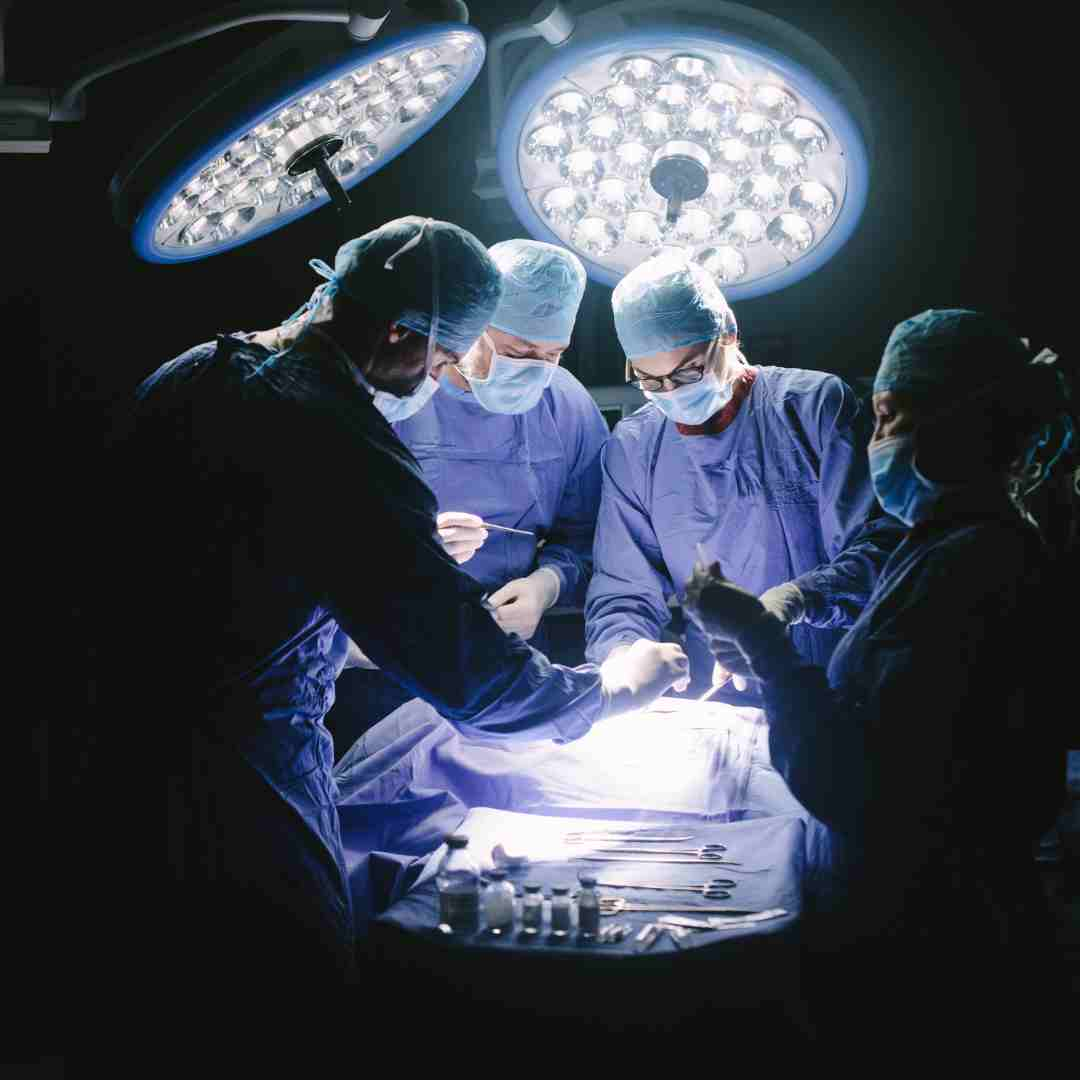

Medical expenses

Procedures & extras

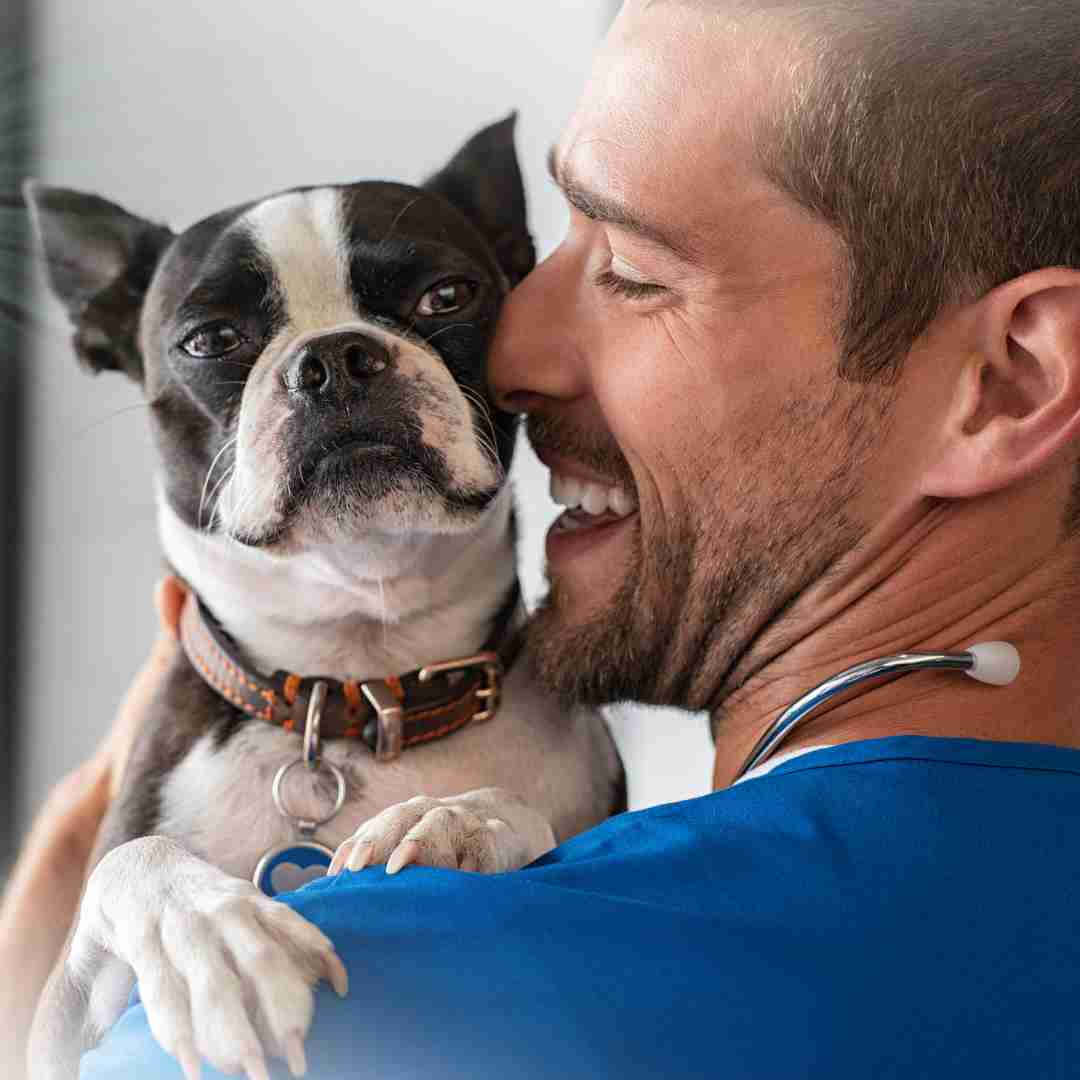

Veterinarian bills

Treatment & overnight care

Moving expenses

Bond, vehicle hire, services

Rates and Fees

Simple & transparent fees structures

We offer an individualised application process to ensure borrowers with strong financial history, including a good credit score, stable income, savings, low debt-to-income ratio, and valuable assets, receive the best rates.

Larger loans

Up to $80,000

| Large loans (personal) | |

| Loan amounts | $5,001 – $80,000 |

| Loan term | 3 – 7 years |

| Establishment fee | $310-$1035 |

| Monthly fee | $0 |

| Interest rate | 7.24% – 19.99% |

Medium loans

Up to $5,000

| Medium loans (MAAC) | |

| Loan amounts | $2,001 – $5,000 |

| Loan term | 3 – 24 months |

| Establishment fee | $400 |

| Monthly fee | $0-$18 |

| Interest rate | 19% – 48% |

Small loans

Up to $2000

| Small loans (SAAC) | |

| Loan amounts | $500 – $2,000 |

| Loan term | 1 – 12 months |

| Establishment fee | 20% |

| Monthly fee | 4% |

| Interest rate | N/A |

Second chance loans

$500 with no credit check

| Second chance loans (SAAC) | |

| Loan amounts | $500 |

| Loan term | 1 – 12 months |

| Establishment fee | 20% |

| Monthly fee | 4% |

| Interest rate | N/A |

Why Cash Today?

Responsible lending practices

Borrow Smart, Repay with Confidence

Only borrow what fits your budget, with transparent rates and fees for informed financial decisions

Personalized Rates, Tailored Solutions

Get a loan rate that reflects your unique financial situation and saves you money

Your Credit Story, Your Rate

We consider more than just a credit score to offer you a competitive rate, and rewards great credit scores

Rates as Unique as You Are

Individual circumstances, individual rates – check your rate today obligation free in just a few minutes

Tailored Financing Solutions

Quick Fixes to Long-Term Plans: We offer a range of options to fit your needs. Pay your loan back your way.

Check Eligibility Easily

See if you qualify without any impact on your credit score, then decide if you want to apply

How it works

Information

Fees & charges >>

Required documents >>

Approval >>

Getting paid >>

Repaying the loan >>

Loan amount

Decide whether you would like a small loan of $1000, SAAC loan up to $2000, MAAC loan up to $5000, or personal loan up to $10,000, $25,000, or more.

Required

- Proof of Australian residency (utility bill) and regular income

- Driver’s licence or other identification (over 18 years of age)

- A read-only 90-day banks statement (via online bank verification)

- Credit check

- Repayment affordability can be established

- No direct debit dishonour transactions in bank statements

Match with a lender

After applying, your result will be shown within 60 seconds, and the decision confirmed within hours. If approved, money is deposited into your bank account that evening if you are approved before 2pm.

Fees & charges

Personal loans will have varying interest rates depending on whether the loan is secured/unsecured, amount, and your financial situation.

Loans $25,000 - $80,000

Step 1: Select the loan type and amount

Step 2: Compare different loan rates from panel of over 60 lenders and choose your loan

Step 3: Provide your details

Step 4: Receive your provisional approval decision and loan rate (within 60 seconds)

Step 5: If the loan terms are acceptable, proceed with the loan application

Step 6: Review loan terms & accept lender offer – either on screen or via email

Step 7: Authorise a read-only 90 day bank statement verification

Step 8: Lender assessment – additional documents or information may be requested, as well as a credit check (typically 24-48 hours, but can be within a few hours if no additional information is needed)

Step 9: Same day payment is processed for approved loan offers accepted before 2 pm AEST

Loans $5,001 - $25,000

Step 1: Provide your details and select the loan amount and reason

Step 2: View your loan interest rate offer and provisional approval decision (within 60 seconds)

Step 3: If the loan terms are acceptable, proceed with the loan application

Step 4: Review loan terms & accept lender offer – either on screen or via email

Step 5: Authorise a read-only 90 day bank statement verification

Step 6: Lender assessment – additional documents or information may be requested, as well as a credit check (typically 24-48 hours, but can be within a few hours if no additional information is needed)

Step 7: Same day payment is processed for approved loan offers accepted before 2 pm AEST

Loans up to $5,000

Step 1: Provide your details and select the loan amount and reason

Step 2: Authorise a read-only 90 day bank statement verification

Step 3: Receive your provisional approval decision (within 60 seconds)

Step 4: Review the loan terms & accept lender offer – either on screen or via email

Step 5: Final lender assessment, including a credit check

Step 6: Same day payment is processed for approved loan offers accepted before 2 pm AEST

Breaking the Cycle

Beyond the Quick Fix: Safe Loan Options and Resources for Informed Decisions

Short Term Loan Traps: Recognizing Risky Options

While payday loans might seem like a quick and easy fix, they can be a potential debt trap. High establishment fees and ongoing charges quickly inflate the cost of borrowing. The short repayment terms can strain your budget, making it difficult to repay on time and leading to even more fees.

Additionally, payday lenders often have minimal eligibility requirements and may not consider your ability to repay, potentially pushing you to borrow more than you can afford and sinking you deeper into debt.

Finding Safe Alternatives to Payday Loans

Unlike payday loans, SAAC & MAAC Loans offer a safe and responsible path to managing your finances. These government-backed loans come with longer repayment terms, giving you more breathing room to repay comfortably. SAAC & MAAC lenders assess your financial situation to ensure the loan amount is manageable for your budget.

They also offer flexible repayment options and may even waive fees in cases of hardship. This responsible approach helps you avoid the debt trap of payday loans and provides a sustainable way to address your financial needs.

Financial Wellness

- Second chance loans

- Centrelink and low income loan options

- Financial counselling & budgeting

Second chance loans

$500 no credit check loans

Second Chance Loans

If you would like to improve your credit rating you might consider a Cash Today second chance loan.

This is a small no credit check loan of $500 which can help you to improve your credit rating if you make your repayments on time.

You may be able to be approved if you have stable income, your regular income vs. expenses allows for you to comfortably afford the repayments, and your 90 day bank statements display no disqualifying conditions.

This is the only kind of no credit check loan that we offer, and all loan amounts higher than $500 will involve a credit check.

Centrelink and low income loan options

No Interest Loan Scheme (NILS)

Borrow up to $2,000 for essential purchases interest free and with no credit check required

To qualify you need to:

- Have a Health Care Card/Pension Card or be on a low income

- Have lived at your current residence at least 3 months

- Be able to make the repayments

Arrange a meeting with a NILS service provider to complete your loan assessment and work out how much you can afford to repay.

This usually takes between 45 and 90 minutes, and loan approvals can take up to 2 weeks depending on the provider.

If you are entitled to government benefits, it may be possible to request a cash advance from Centrelink

Financial Counselling & Budgeting

- The Government website MoneySmart is an invaluable resource to assist with financial counselling, budgeting, saving for an emergency fund, and assistance with paying bills.

- Get information about other options for managing your unexpected bills or debts by calling 1-800-007-007 from anywhere in Australia to talk to a free and independent financial counselor.

- Speak directly to your service provider to see if you can work out a payment plan if you aren’t able to pay your bills on time.

How much do you need to borrow?

What Our Customers Are Saying

Frequently asked questions

Why would I need a short term loan?

Sometimes despite your very best budget planning, you get hit with an unforeseen bill. Perhaps you need cash to take care of an emergency, or an opportunity comes up and you just can’t let it pass you by. You may need some extra cash within 24 hours. In this case, you don’t want the hassle and stress of long application times and piles of paperwork.

What is an emergency loan?

Sometimes you can plan for an emergency, and sometimes you can’t. For instance, your car breaking down, replacing a phone that was damaged, or paying to fix a costly water leak. Whatever your emergency there are times when you need to pay a bill ASAP, and you can count on Cash Today for fast approval and cash deposited into your account just when you need it.

What about unexpected expenses?

Unexpected expenses can arise even with the best budgeting and planning strategies. Perhaps you need a loan for medical expenses like emergency dental work, or your electricity bill was higher than expected, plus the bill came for your car registration all in the same week! Maybe you’ve been tracking along well with your finances and then had an appliance break down. Replacing a white goods product like a fridge, dishwasher, or washing machine can be tricky to cover when you are on a budget.

It could be that your renovation budget has blown out, and you need to cover the difference to get the home project complete. What about those opportunities that would save you money long term but you don’t have the funds on hand to take advantage on short notice? This could be something like a sale on flights or accommodation for that overseas holiday you had planned. Another example could be moving expenses – you are paying bond, paying rent in advance, or hiring a moving truck. There are so many reasons why being able to borrow with a small or medium loan could help you out when you need cash fast.

So what are your options? Cash advances on credit cards come with hefty fees, and you may feel uncomfortable borrowing from family or friends. If you have been searching for instant approval loans because you need cash today, a small online payday loan might be an option you are considering. Quick easy loans, in just minutes.

About Cash Today

We have been offering short-term credit contracts to Australians since 2006. We operate under the Australian Credit License No: 387137. We are dedicated to offering easy loans quickly but do so only if loan applications are in line with our criteria for responsible lending and the National Consumer Credit Protection Act 2009. You can read more about this here.

While it can be tempting to look to instant approval loans when you need cash today, we want to make sure that our online loans are the right fit for our customers. In automating systems some applications could be declined unnecessarily, such as explainable data from bank statements. Our online application form approvals are done by real people so you can be assured that the application process will take into consideration the most important information for your personal loan.

We are happy to be able to offer a loan status within just a few hours of receiving an completed application form within business hours as well as a full summary of fees and charges, and we have hundreds of happy returning customers because of our more personal approach to lending and reputation as a responsible lender.