Personal Loans:

Loans up to $80,000

How it works

Apply for a loan in minutes

Same-day approvals

Cash paid fast

Step 1: Fill out the quick application form

Step 2: Authorise the 90-day online bank statement collection

Step 3: Get your loan approval decision

It’s two simple steps to connect you to the right lender.

Weddings & events

Celebrations & functions

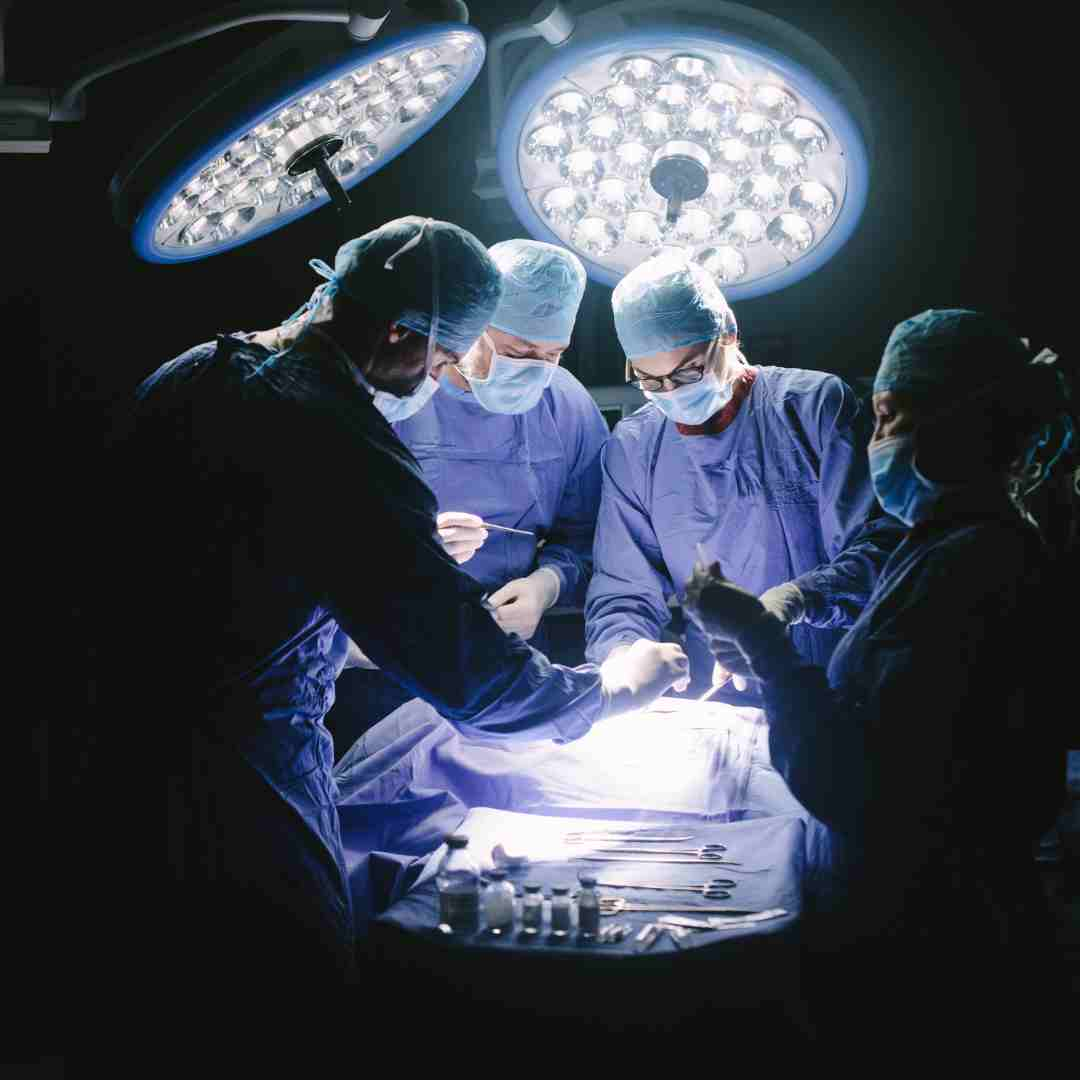

Medical expenses

Procedures & extras

Purchases

Furniture, electronics, white goods

Travel & leisure

Exciting experiences

Moving expenses

Bond, vehicle hire, services

Veterinarian bills

Treatment & overnight care

Emergency loans

Unexpected expenses

Same-day payments into your designated bank account for applications approved before 2 pm AEST.

How it works:

Fees & charges >>

Required documents >>

Approval >>

Getting paid >>

Repaying the loan >>

Fees & charges

The interest rate will depend on the type of loan (secured or unsecured), the loan amount, and the applicant’s financial situation. You might expect to pay on average 8-20% interest.

Required

- Proof of Australian residency (utility bill) and regular income

- Driver’s licence or other identification (over 18 years of age)

- A read-only 90-day banks statement (via online bank verification)

- Credit check

- Repayment affordability can be established

- No direct debit dishonour transactions in bank statements

Getting paid

If your application is received before 2 pm AEST, the approval status will be shown within 60 seconds, and the decision confirmed within hours. If approved, money is deposited into your bank account that evening.

Repaying the loan

Paersonal loans for amounts between $5000 – $10,000, might be repaid over a duration of 3-7 years.

Ensure that you feel confident that you will be able to make your repayments before applying for a loan.

Special circumstances:

We offer options for customers who may have difficulty obtaining a loan, such as customers receiving Centrelink income (or other benefits) or with bad/no credit rating. These are different to SAAC loans.

Before applying, please ensure that you have read the warning about borrowing, and understand our terms and conditions.